AI-Driven Personalization and Automation: Transforming the Insurance Industry in 2025

AI in Insurance: Revolutionizing the Industry

AI in Insurance: Revolutionizing the Industry

As we move into 2025, artificial intelligence (AI) is set to play an increasingly important role in the insurance industry. The transformative power of AI is reshaping how insurers operate, enhancing efficiency, improving customer experience, and driving innovation. This blog post explores the key trends and advancements in AI technology that are revolutionizing the insurance sector, from personalized service and claims processing to fraud detection and risk management.

Why AI-Powered Personalization Will Be Essential in the Insurance Sector

In 2025, insurers will continue to leverage AI to create highly personalized customer journeys, providing individualized policy options, pricing, and recommendations. AI's ability to analyze vast amounts of customer data will allow insurers to offer tailored products that align with each customer’s specific needs, preferences, and behaviors. This hyper-personalized approach will lead to better customer retention, improved satisfaction, and enhanced brand loyalty, as consumers will increasingly expect companies to provide services that feel uniquely crafted for them.

Personalization in insurance is not just about offering the right product at the right time; it’s about creating a seamless and engaging customer experience.

For example, if a customer frequently travels, AI can suggest travel insurance options tailored to their destinations and travel habits. This level of personalization can significantly enhance the customer experience, making interactions with insurers more relevant and valuable.

How Will AI Enable Real-Time Claims Processing and Customer Feedback in Insurance?

With AI advancements, insurers in 2025 will move toward real-time claims processing. By utilizing AI-driven tools to immediately assess claims, validate data, and process approvals, insurance companies will significantly speed up the claims experience. In addition, AI will help collect and analyze customer feedback post-claims, enabling insurers to identify pain points and continuously improve their service delivery. This approach will enhance customer satisfaction, as claimants will benefit from quicker resolutions and more transparent interactions.

Real-time claims processing is a game-changer for the insurance industry. Traditional claims processing can be time-consuming and cumbersome, often leading to customer frustration. AI can streamline this process by automating routine tasks, such as data entry and verification, allowing human agents to focus on more complex issues. Moreover, AI can analyze claims data to detect anomalies and flag potential fraud, ensuring that legitimate claims are processed swiftly while fraudulent ones are investigated thoroughly.

Digital-First Insurance Onboarding Will Set the Industry Standard

In 2025, insurance companies will adopt fully digital-first onboarding experiences to meet the growing demand for quick, convenient service. Using AI to automate identity verification, risk assessment, and policy customization, insurers will reduce the time and complexity of acquiring new customers. This will also allow insurers to offer a seamless experience that enhances customer satisfaction from the moment a policy is first issued, driving higher conversion rates and improved customer engagement.

The digital-first approach to onboarding is essential in today’s fast-paced world, where customers expect instant gratification. AI can facilitate this by automating various steps in the onboarding process, such as verifying customer identities using biometric data, assessing risk profiles based on historical data, and customizing policies to meet individual needs. This not only speeds up the process but also reduces the likelihood of errors, ensuring a smooth and efficient onboarding experience.

How Can Insurance Companies Integrate AI into Risk Assessment for More Accurate Pricing?

In 2025, AI will be leveraged in insurance risk assessment, helping firms offer more accurate, personalized pricing for policies. By analyzing client data, environmental factors, and broader market trends, AI will help insurers assess risk more effectively and create dynamic pricing models that adjust in real-time based on the evolving risk landscape. This will enable insurers to provide customers with fairer premiums while reducing financial exposure and loss ratios, ultimately leading to higher levels of customer trust and loyalty.

Accurate risk assessment is crucial for the sustainability of the insurance industry. AI can analyze a vast array of data points, from individual health records to environmental conditions, to determine the likelihood of a claim being made. This allows insurers to price policies more accurately, ensuring that customers are charged premiums that reflect their actual risk levels. Additionally, AI can continuously monitor and update risk assessments, allowing insurers to adjust premiums in real-time as new information becomes available.

AI-Powered Automation Will Optimize Risk and Compliance in the Insurance Sector

By 2025, AI will be integrated into risk management and compliance workflows for insurers. AI systems will automate tasks such as compliance monitoring, regulatory reporting, and risk analysis, allowing insurers to detect potential issues faster and more accurately. This will help reduce human error, ensure regulatory compliance, and lower operational costs. As insurers face more stringent regulations and increasingly complex risk environments, automation will enable them to stay ahead of compliance requirements.

Compliance is a significant challenge for insurers, given the complex and ever-changing regulatory landscape. AI can help by automating compliance-related tasks, such as monitoring transactions for suspicious activity, generating reports for regulatory bodies, and analyzing data to identify potential compliance risks. This not only reduces the burden on human employees but also ensures that compliance processes are more accurate and efficient.

Fraud Detection: Can Insurers Leverage AI to Combat Fraudulent Claims?

Fraud detection is a critical area where AI is making significant strides. In the insurance industry, fraudulent claims can lead to substantial financial losses. AI technology, including machine learning and natural language processing, can analyze unstructured data and identify patterns indicative of fraud.

AI-driven fraud detection systems can analyze vast amounts of data from various sources, such as social media, transaction records, and customer communications, to identify suspicious patterns. For example, if a customer files multiple claims for similar incidents within a short period, AI can flag this as potential fraud and trigger an investigation. This proactive approach to fraud detection can save insurers significant amounts of money and protect honest customers from the negative impacts of fraud.

Generative AI: Transforming Customer Interactions and Personalized Service

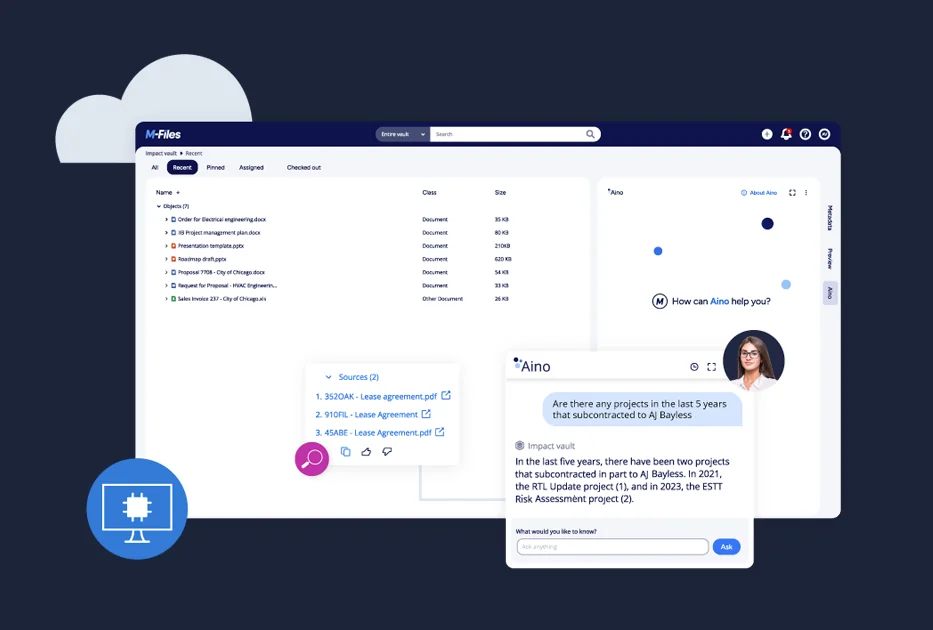

Generative AI is set to revolutionize customer interactions in the insurance sector. Virtual assistants powered by generative AI can provide more personalized service by understanding and responding to customer queries in natural language. These AI-powered virtual assistants can handle a wide range of tasks, from answering policy-related questions to assisting with claims processing. By offering more personalized service, insurers can improve customer experience and meet the growing expectations of their customers.

For instance, a virtual assistant can use natural language processing to understand the context of a customer’s query and provide relevant information or assistance. This can significantly enhance the customer experience, as customers receive timely and accurate responses to their questions, without the need to wait for a human agent.

What is the Role of Third-Party Data in Enhancing AI Capabilities

Third-party data is becoming increasingly important in the insurance industry. By integrating third-party data sources, insurers can enhance their AI capabilities and gain deeper insight into customer behavior and risk factors. This data can be used to optimize pricing, improve risk modeling, and provide more accurate underwriting. The use of third-party data, combined with AI technology, allows insurers to make more informed decisions and offer better products and services to their customers.

Third-party data can provide valuable insights that are not available through internal data sources alone. For example, data from social media platforms can reveal information about a customer’s lifestyle and behavior, which can be used to assess risk more accurately. Similarly, data from public records can provide insights into environmental risks, such as the likelihood of natural disasters in a particular area. By integrating these data sources with AI, insurers can create more comprehensive and accurate risk models.

Managing Risk with AI: Improving Operational Efficiency and Decision-Making

AI technology is transforming how insurers manage risk. By analyzing vast amounts of data, AI can identify potential risks and provide insights that help insurers make better decisions. This includes optimizing pricing, improving underwriting accuracy, and enhancing claims management.

Effective risk management is essential for the long-term success of insurance companies. AI can help by providing real-time insights into emerging risks, allowing insurers to take proactive measures to mitigate them. For example, AI can analyze weather patterns to predict the likelihood of natural disasters and adjust policies accordingly. This not only helps insurers manage risk more effectively but also ensures that customers are adequately protected.

The Potential Benefits and Risks of AI in the Insurance Industry

The adoption of AI in the insurance industry offers numerous potential benefits, including improved efficiency, enhanced customer experience, and better risk management. However, there are also potential risks to consider, such as data privacy concerns and the need for robust regulatory compliance. Insurers must navigate these challenges carefully to maximize the benefits of AI while mitigating potential risks.

One of the primary benefits of AI is its ability to process and analyze large amounts of data quickly and accurately. This can lead to significant improvements in efficiency, as tasks that previously took hours or days can now be completed in minutes. Additionally, AI can enhance the customer experience by providing personalized service and faster claims processing. However, the use of AI also raises concerns about data privacy and security. Insurers must ensure that they have robust measures in place to protect customer data and comply with relevant regulations.

The Future of AI in Insurance: Embracing Innovation and Staying Ahead

As we look to the future, the transformative power of AI in the insurance industry is undeniable. Insurers that embrace AI technology and stay ahead of the curve will be well-positioned to thrive in an increasingly competitive market. By leveraging AI for personalized service, real-time claims processing, fraud detection, and risk management, insurers can enhance their operational efficiency, improve customer satisfaction, and drive innovation.

Insurers that invest in AI research and development can create new products and services that meet the evolving needs of their customers. For example, AI can enable the development of usage-based insurance models, where premiums are based on actual usage rather than fixed rates. This can provide more flexibility and value to customers, while also allowing insurers to better manage risk.

How to Navigate the Evolving Landscape of AI in Insurance

The landscape of AI in insurance is rapidly evolving, with transformative trends shaping the future of the industry. AI agents, no-code environments, and natural language processing are making AI more accessible and powerful. Data integrity and management are becoming critical enablers for AI decision-making, while diverging regulations are creating new challenges for global enterprises. By staying informed and agile, businesses can harness the potential of AI to drive innovation, efficiency, and growth. The future of enterprise solutions is promising, and those who embrace these advancements will lead the way in an increasingly competitive market.

In conclusion, the insurance industry in 2025 will be vastly different from what it is today, thanks to the transformative power of AI. Insurers that leverage AI to enhance personalization, streamline claims processing, improve risk assessment, and detect fraud will be well-positioned to succeed. However, it is essential for insurers to navigate the challenges associated with AI, such as data privacy and regulatory compliance, to fully realize its potential. By embracing AI and staying ahead of the curve, insurers can drive innovation, improve customer satisfaction, and achieve sustainable growth in the years to come.

By Yohan Lobo, Industry Solutions Manager, Insurance and Wealth Management at M-Files