How AI & Automation Are Changing Wealth Management

AI and Automation: Driving Efficiency and Accessibility in Wealth Management

Looking Into the Future of AI and Automation in Wealth Management

In recent years, the wealth management industry has witnessed a significant transformation driven by advancements in artificial intelligence (AI) and automation. These technologies are not only streamlining operations but also enhancing client interactions and democratizing financial advice. We will explore how AI and automation are revolutionizing wealth management, providing insights into their impact on operational efficiency, predictive client insights, accessibility of advisory services, and self-service capabilities.

How Are AI and Automation Reshaping Operational Efficiency in Wealth Management?

In 2025, wealth management firms are expected to fully embrace knowledge work automation platforms to automate back-office processes such as document management and data analysis. This shift will enable wealth managers to focus more on high-touch client interactions and strategy development, significantly reducing the manual workload that currently hinders service and productivity.

By enhancing operational workflows, wealth management firms can offer clients more timely and personalized advice while improving cost efficiency across their operations. This means clients will receive better service and more accurate financial guidance, ultimately leading to improved financial outcomes.

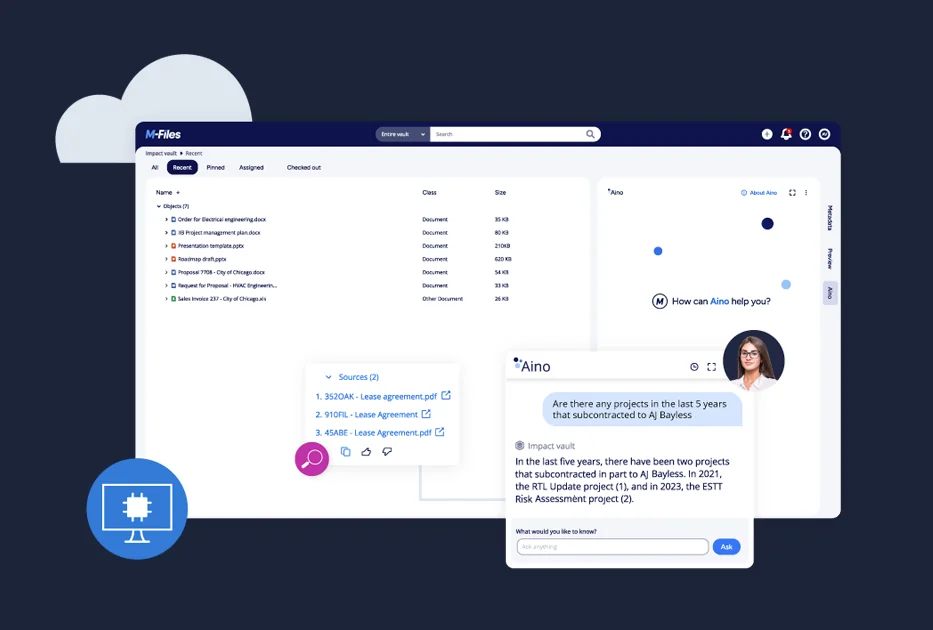

Streamlining Document Management

One of the key areas where automation will make a significant impact is in document management. Wealth management involves handling a vast amount of paperwork, from client records to compliance documents. Automating these processes will reduce the time spent on manual data entry and retrieval, allowing wealth managers to access information quickly and efficiently.

Enhancing Data Analysis

Data analysis is another critical aspect of wealth management that will benefit from automation. By leveraging AI-powered tools, wealth managers can analyze large datasets to identify trends, assess risks, and make informed decisions. This capability will enable firms to provide clients with more accurate and timely advice, enhancing the overall client experience.

How To Unlock Predictive Client Insights with the Power of AI and Automation

Wealth management firms are increasingly relying on AI to not just react to client needs but to predict them. By analyzing past behaviors, market trends, and financial goals, AI enables wealth managers to offer proactive advice on investment opportunities, portfolio adjustments, and risk mitigation strategies.

This predictive capability empowers advisors to anticipate market changes and advise clients on actions before those shifts occur. As a result, clients can make more informed decisions, potentially increasing their investment returns and achieving their financial goals more effectively.

Proactive Investment Advice

AI's ability to analyze vast amounts of data allows wealth managers to identify investment opportunities that may not be immediately apparent.

This proactive approach helps clients stay ahead of market changes and capitalize on emerging opportunities.

Portfolio Adjustments

AI can also assist in making timely portfolio adjustments. By continuously monitoring market conditions and client portfolios, AI can recommend changes to asset allocations to optimize returns and manage risks. This dynamic approach ensures that clients' portfolios remain aligned with their financial objectives, even in volatile markets.

Risk Mitigation Strategies

Risk management is a crucial aspect of wealth management, and AI can play a significant role in this area. By analyzing historical data and market indicators, AI can identify potential risks and suggest strategies to mitigate them. This proactive approach helps clients protect their investments and achieve long-term financial stability.

How AI-Driven Advisory Services Will Make Wealth Management More Accessible Than Ever

In 2025, the democratization of financial advice will be a key trend in wealth management. AI-driven tools will open automated, yet personalized, investment advice to a broader audience. Mass affluent clients will have access to sophisticated, AI-powered advisory platforms that offer personalized recommendations based on risk tolerance and financial goals.

This trend makes wealth management more accessible to a wider demographic, enabling firms to expand their client base while maintaining high-quality, customized services. Clients who previously couldn't afford personalized financial advice will now have access to tailored investment strategies, helping them build and manage their wealth more effectively.

AI-Personalized Recommendations

AI-driven advisory platforms can provide personalized recommendations based on individual client profiles. By analyzing factors such as risk tolerance, financial goals, and investment preferences, these platforms can offer tailored advice that meets the unique needs of each client. This level of personalization was previously only available to high-net-worth individuals but is now accessible to a broader audience.

Cost-Effective Solutions

AI-driven advisory services are also more cost-effective than traditional wealth management services. By automating many of the tasks typically performed by human advisors, these platforms can offer high-quality advice at a lower cost. This affordability makes wealth management accessible to a larger number of clients, including those with smaller portfolios.

Expanding Client Base

By offering AI-driven advisory services, firms can attract mass affluent clients who may have been underserved by traditional wealth management services. This expansion not only increases revenue but also helps firms build long-term relationships with a diverse range of clients.

How Will AI Supercharge Self-Service Capabilities in Wealth Management?

Wealth management firms will continue to enhance their self-service offerings through AI-powered chatbots and virtual assistants. Wealth managers will use AI-driven tools to offer clients self-service access to portfolio tracking, investment adjustments, and financial planning.

This increase in self-service capabilities empowers clients to take control of their financial planning and investment management. By providing easy access to essential tools and information, clients can make informed decisions independently, leading to greater satisfaction and better financial outcomes.

AI-Powered Chatbots

AI-powered chatbots are becoming increasingly common in the wealth management industry. These virtual assistants can handle a wide range of tasks, from answering client inquiries to providing investment recommendations. By offering 24/7 support, chatbots ensure that clients have access to the information they need at any time, enhancing the overall client experience.

Empower Clients with AI-Driven Self-Service Tools

Wealth management firms are also developing self-service tools that allow clients to manage their investments independently. These tools provide clients with access to portfolio tracking, investment adjustments, and financial planning resources. By empowering clients to take control of their financial decisions, these tools enhance client satisfaction and engagement.

Use Data-Driven Insights to Provide Actionable Insights

AI-driven self-service tools can also provide clients with valuable data-driven insights. By analyzing client behavior and market trends, these tools can offer personalized recommendations and actionable insights. This information helps clients make informed decisions and achieve their financial goals more effectively.

Making Investing Smarter With the Integration of AI and Automation

The integration of AI and automation in wealth management is making investing smarter and more accessible by automating insights, improving efficiency, and enhancing client experiences. As these technologies continue to evolve, they will play an increasingly vital role in shaping the future of wealth management, offering clients more personalized, proactive, and accessible services. By embracing these advancements, wealth management firms can better serve their clients and stay ahead in a competitive industry.

By Yohan Lobo, Industry Solutions Manager, Insurance and Wealth Management at M-Files