Work Automation Powers Wealth Management

Wealth management firms are embracing digital transformation. Work automation is changing how financial advisors manage business. Artificial intelligence (AI) and automation will make it possible to do business efficiently and advance the quest to increase speed.

Knowledge work automation replaces endless paperwork and improves productivity. Automating workflows allows wealth management firms to focus on advisory activities and elevate customer experience.

The wealth management sector depends on client relationships and operational efficiency. Work automation aggregates data from multiple sources and updates other systems in real time. It ensures a thorough and up-to-date overview of client portfolios while baking in regulatory compliance into workflows.

Implementing intelligent tools increases performance and reveals exciting growth opportunities. Such tools leverage machine learning algorithms for data analysis. Handing off time-consuming manual tasks to automated workflows drives enhanced productivity and employee satisfaction.

The future of knowledge work also supports work-life balance. Late nights at the office or working around the clock are passe. Financial analysts routinely work more than the 40-hour work week. That’s why wealth management professionals seek solutions to balance work commitments with personal responsibilities.

Working overtime on repetitive tasks that can be automated creates poor morale. The automation of knowledge work helps wealth management companies meet workflow demands in modern working environments.

In a financial firm, automation software fills a wide range of knowledge gaps. It can support market research insights, provide detailed client profiles, track regulatory changes, help suggest personalized investment strategies, and monitor portfolio performance. Firms are increasing their operational budgets to usher in information technologies.

How Work Automation Improves Wealth Management

A digital workplace focuses security breach awareness through real-time monitoring, alerts, encryption, access controls, auditing, and incident response protocols. Document management best practices are essential and keep client information safe. This includes secure document sharing and collaboration. Streamlining, optimizing, and automating institutional knowledge eliminates content chaos and supports high-level decision-making and complex problem-solving.

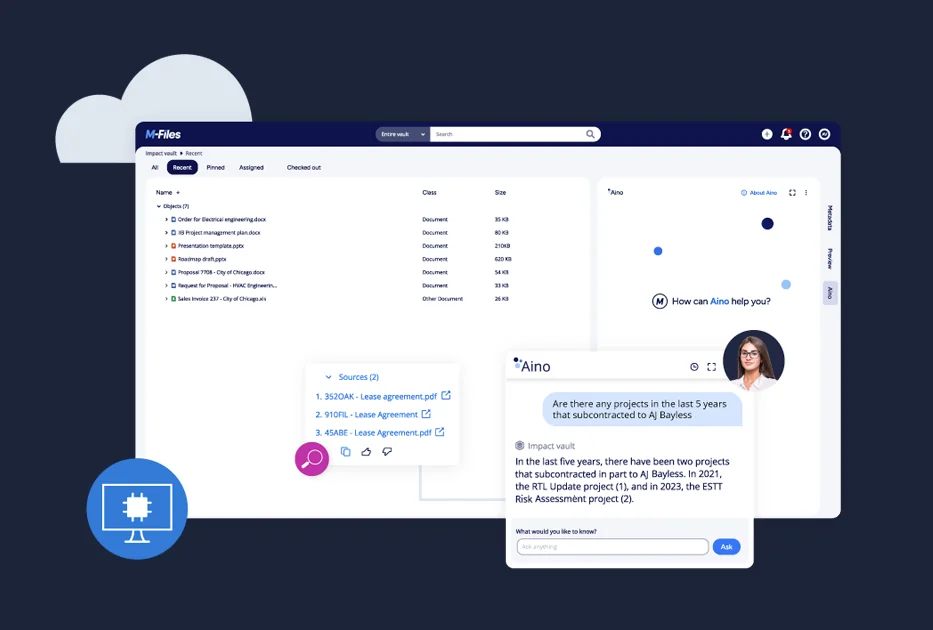

Robotic process automation (RPA) uses software robots to automate data entry, extraction, and report generation tasks including document control and management. Software robots streamline back-office processes, reduce errors, boost efficiency, enhance client experience, and provide an easy-to-navigate user interface.

Lack of access to consistent information leads to file duplication or inaccurate information sharing. Work automation reduces human error. AI and automation tools enable employees to monitor and review financial records or identify errors.

Asset Management and Wealth Management Elevated

Before emerging technologies such as work automation tools, skilled knowledge workers’ responsibilities included manually streamlining business process automation. Sorting through data and adhering to compliance checks increased their workload. Documents were not easily accessible.

Automated systems replace manual data handling, ensuring accurate decision management. Managing large-scale daily trades is complex. Managers at multiple financial institutions must review and validate trades.

Accurately updating customer portfolios increases the chance of human error. Document management software mitigates this risk. Sorting documents by category can help organize client information. Work categories improve workflow structure.

Automating electronic data processes

Quality assurance checks and data validation ensure compliance and accurate filing of client portfolio records within work automation management systems. Managers receive notification signals when problems or discrepancies are present. Asset managers can shift their focus to reviewing issues without delays. Work automation management relieves fiscal pressure due to increasing regulatory protocol costs.

Efficient automation boosts employee satisfaction and morale, productivity, and retention. Firms with satisfied and engaged employees are better equipped to deliver exceptional service to clients. Knowledge management platforms free employees' time to develop relationships and provide advice. Bottom line: It helps them gain a competitive edge.

Asset managers work under intense pressure. Lingering financial penalties require intelligent document auto-tagging. Onboarding new clients while managing existing clients involves multitasking. Growth is reliant on trust and reputation.

Digital document management benefits high-performing firms. It gives advisors real-time access to every client portfolio and the opportunity to delegate tasks. Delegating workload to junior advisors increases productivity. A senior advisor can help high net worth clients with financial planning, investment advice, and portfolio management.

Portfolio clients can receive information about trades or investments digitally. Reducing approval time allows managers to work on multiple trades and accounts. Document storage systems track all behavior.

FAQ

Why are wealth management firms using work automation?

Wealth management firms use work automation software to reduce operation costs, increase growth, and improve work performance.

What is document automation?

Document automation software generates documents automatically, using rules set up for data collection. Employees can locate files in a central database.