Risk and Compliance Management

Optimize risk and compliance management via automation. Ensure bulletproof compliance without overspending on redundant manual controls. Manage company risks systematically, embed compliance controls into daily work, automate records retention, and streamline contract lifecycle management (CLM).

Challenges: Complex regulatory environments lead to costly compliance activities

All companies must follow rules originating from laws and regulations, standards, internal policies, and contracts. Balancing the overhead of additional work and the risk of non-compliance can be challenging. Some organizations invest in dedicated staff and systems, taking a hit on profitability. Others try to manage risks collectively, straining staff and exposing the business to penalties and reputation damage.

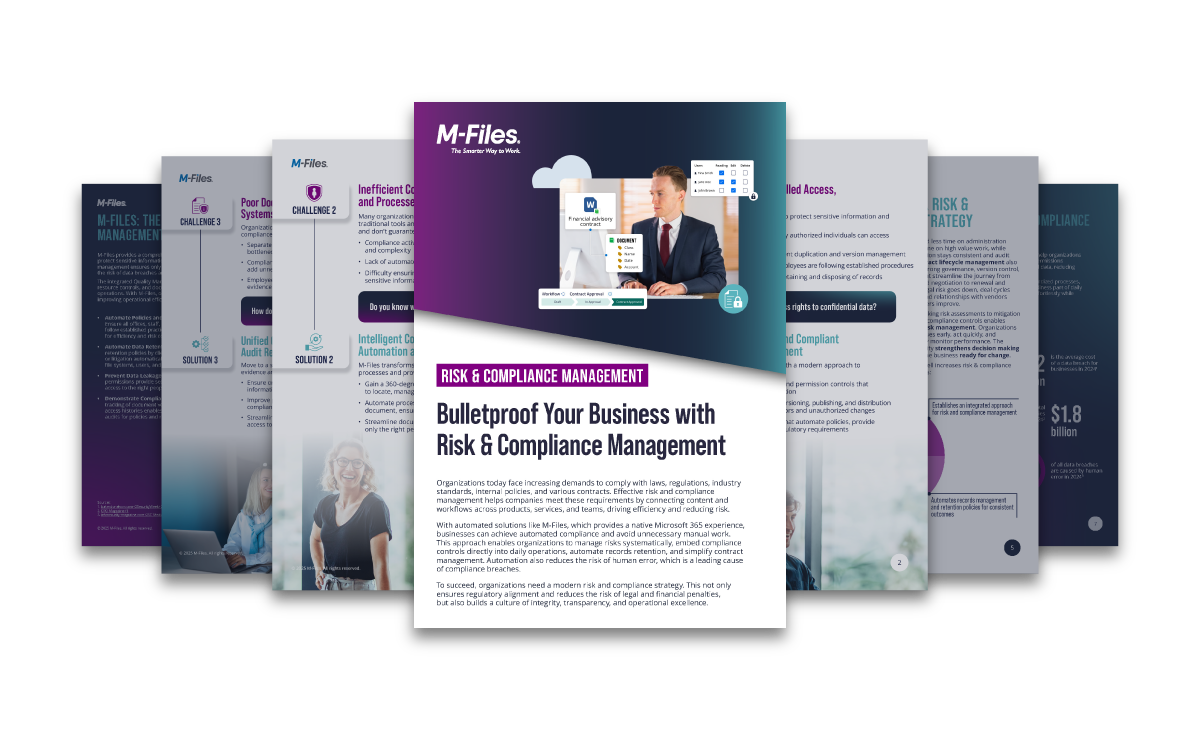

Risk & Compliance Management

Bulletproof Your Business with Risk & Compliance Management

To succeed, organizations need a modern risk and compliance strategy. This approach strengthens regulatory alignment and minimizes legal and financial exposure. It also fosters a culture of integrity, transparency, and operational excellence.

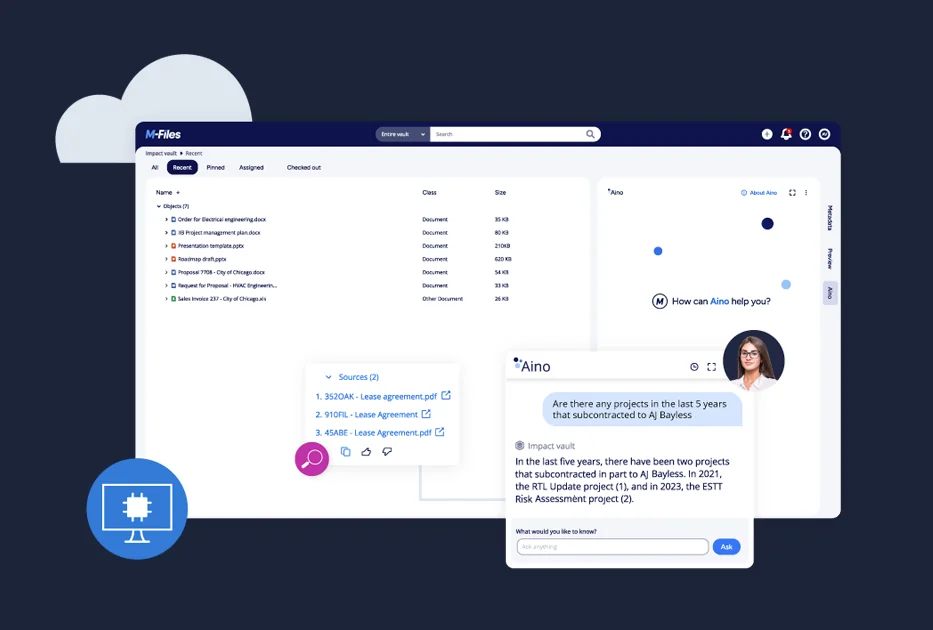

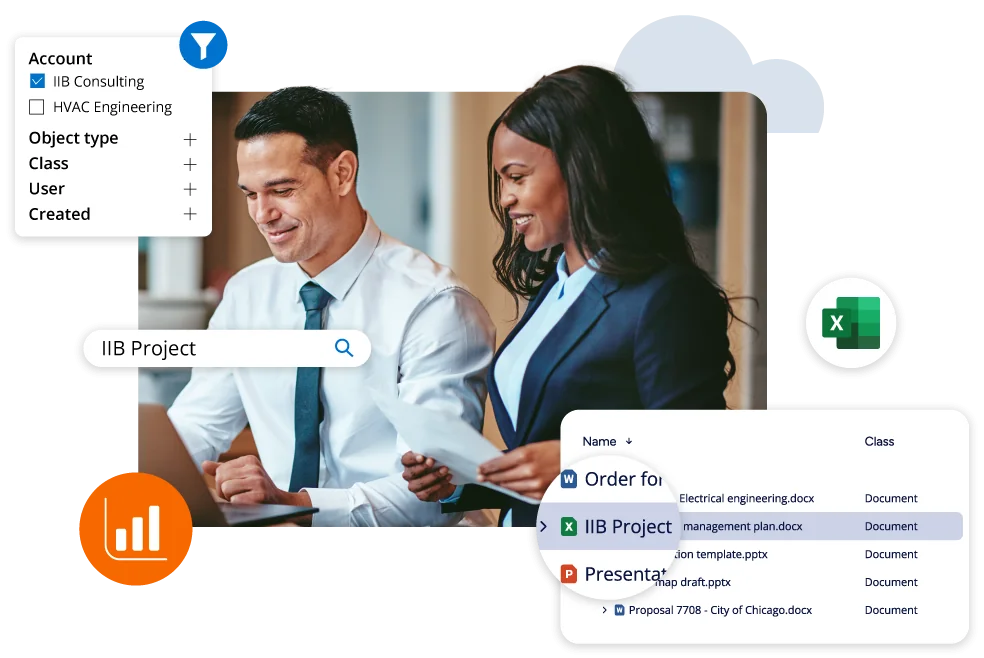

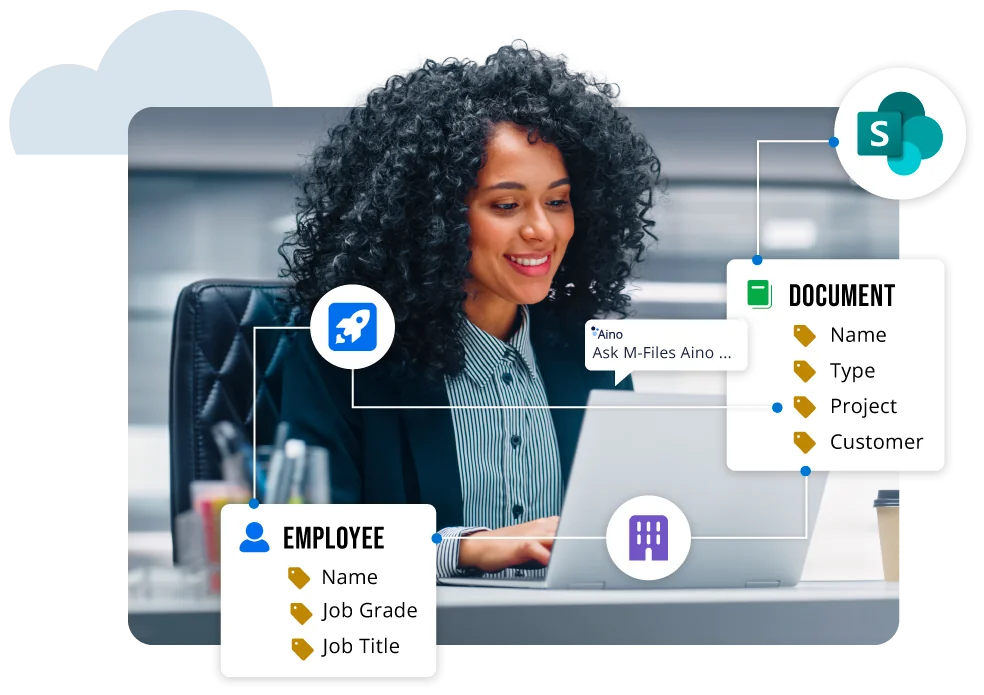

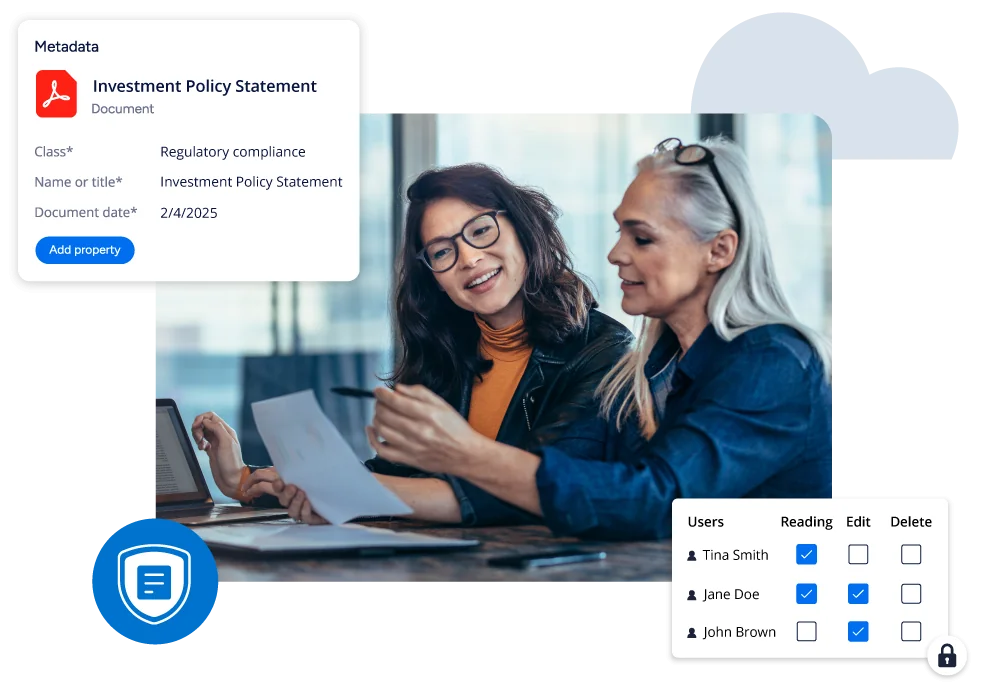

Solution: Integrating risk and compliance management into daily workflows through automation

Establishing an integrated approach for risk and compliance management can significantly reduce redundant efforts and costs. By embedding compliance controls into daily workflows, organizations ensure that regulatory requirements are met effortlessly as part of routine operations. Automating records management further enhances efficiency by systematically archiving necessary documents without manual intervention. Streamlining contract lifecycle management reduces excess costs and mitigates potential business risks through better governance and oversight. Effective document management and workflow automation ensure all records are properly handled and easily accessible.

Solutions for Your Industry

Fulfilling regulatory compliance in Wealth Management

Risk and compliance management plays a pivotal role in maintaining the integrity and trustworthiness of financial institutions. By integrating compliance measures into daily operations, wealth managers can effectively mitigate risks and ensure adherence to regulatory requirements. This proactive approach not only safeguards client assets but also maintains the institution's reputation in the highly regulated financial sector. Through automation and streamlined processes, wealth management firms can achieve greater efficiency and reduce the burden of manual compliance tasks, thereby freeing time for client work while fostering a robust and secure financial environment.

Driving business performance in Manufacturing

In the manufacturing sector, combined risk and compliance management can significantly enhance operational efficiency by identifying and mitigating potential risks before they disrupt production. This integrated approach ensures that compliance controls are seamlessly embedded into daily processes, reducing the likelihood of regulatory breaches and associated penalties. Additionally, it fosters a culture of continuous improvement, where automated systems and document analytics streamline compliance checks and documentation, ultimately leading to higher quality products and greater customer satisfaction.

Customer Case Studies

More than 5,000 companies rely on M-Files to manage their documents every day.